ViTrox Corporation Berhad is an automated test equipment (ATE) maker principally engaged in the development and production of vision inspection systems and printed circuit board assemblies for microprocessor applications. The company specializes in Machine Vision System (MVS) and Automated Board Inspection (ABI) products.

Key Services: Provides development and production of vision inspection systems and printed circuit board assemblies.

Geographic Exposure: ViTrox is listed on KLSE (Malaysia). Its exports heavily include electrical and electronic (E&E) products, such as semiconductors and integrated circuits, to the US. The company also sees improving utilization from outsourced semiconductor assembly and test (OSAT) and integrated device manufacturers in China.

2. Financial Performance (Q1 FY2025 vs. Q1 FY2024)

ViTrox’s financial results for the first quarter ended March 31, 2025 (1Q25) were announced on April 24, 2025

Key Metrics (Year-on-Year: 1QFY2025 vs 1QFY2024)

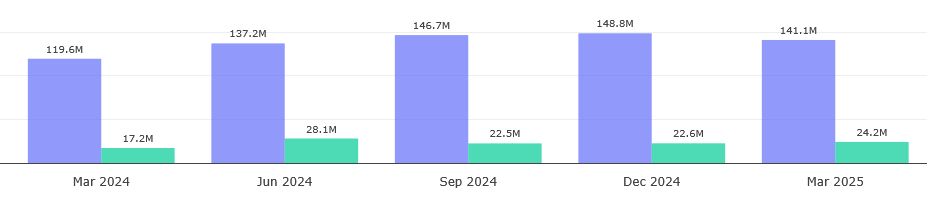

| Metric | 1Q25 (RM’000) | 1Q24 (RM’000) | Change (RM’000) | Change (%) |

| Revenue | 141,118 | 119,613 | +21,505 | +18.0% |

| Profit before tax | 27,413 | 18,848 | +8,565 | +45.4% |

| Profit attributable to owners | 24,160 | 17,230 | +6,930 | +6,930 |

| Basic earnings per share (sen) | 1.28 | 0.91 | +0.37 | +40.7% |

Highlights:

• The Group recorded a significant year-over-year increase in revenue by 18.0% to RM141.1 million, and profit before tax surged by 45.4% to RM27.4 million. This growth was primarily driven by the recovery in demand for the Machine Vision System (“MVS”) and Automated Board Inspection (“ABI”) segments.

• The improvement in profit before tax was largely attributed to stronger revenue performance and a more favourable product mix.

• ViTrox’s net profit rose by 40.2% year-on-year to RM24.16 million, marking its first quarterly earnings growth since 4Q22.

• The company also observed margin recovery, with its EBITDA margin expanding by 5.7 percentage points year-on-year to 22.8%.

• On a quarter-on-quarter basis, while revenue saw a marginal decline of 5.2%, primarily due to a slight dip in the MVS segment, net profit increased by 7% from the preceding quarter.

• The results were supported by improving utilization at outsourced semiconductor assembly and test (OSAT) and integrated device manufacturers in China.

• ViTrox did not declare any dividend for the first quarter under review. However, it paid an interim tax-exempt dividend of 0.50 sen per share (RM9.46 million) for FY2024 on January 17, 2025. A final tax-exempt dividend of 0.70 sen per share for FY2024 was proposed on April 9, 2025, subject to members’ approval.

• The Group’s effective tax rate for the period was lower than the statutory 24% due to a pioneer status tax incentive granted to its wholly-owned subsidiary, ViTrox Technologies Sdn. Bhd. (VTSB), which is effective until June 16, 2025.

3. Growth Drivers vs. Risks

Opportunities:

• Strong Long-Term Semiconductor Outlook: Despite near-term challenges, the long-term outlook for the semiconductor sector remains strong.

• Emerging Technology Demand: Robust double-digit growth is expected in 2025, fueled by the sector’s pivotal role in generative AI, 5G, high-performing computing, medical devices, aerospace, and electric vehicles.

• Structural Trends: The company is expected to benefit from structural trends such as AI-driven infrastructure growth and the nationalization of semiconductor supply chains.

• Strategic R&D Investment: ViTrox plans to continue investing strategically in research and development to strengthen its leadership and capture emerging opportunities.

• Stabilizing Demand: The company’s book-to-bill ratio improved to 1.3x at the end of 1Q25 from 1.1x in the previous quarter, indicating stabilizing demand.

• Technology Leadership: The company possesses technology leadership and operates with an asset-light model.

📈 Semiconductor boom (AI, 5G, EVs, medical devices)

🔬 R&D investments to maintain tech leadership

🌏 China demand recovery (OSAT & IDM utilization improving)

Risks:

• Macroeconomic and Sectoral Risks: Both CIMB Securities and HLIB remain cautious about the near-term outlook, citing persistent macroeconomic and sectoral risks.

• Geopolitical Tensions and Trade Disputes: The company faces near-term challenges from geopolitical tensions and trade disputes, including US-China tariff risks, which may weigh on capital spending and equipment demand.

• Cyclical Industry: The Group’s operation is dependent on the cyclical trend of the semiconductors and electronics industries.

• Valuation Concerns: The stock is perceived by some analysts as trading above its 10-year average P/E ratio at 42.6x FY25F earnings. Alpha Spread analysis indicates ViTrox Corporation Bhd is Overvalued by 30% based on an intrinsic value of 2.55 MYR compared to its current market price of 3.66 MYR.

• Earnings Shortfall (HLIB View): HLIB noted that 1Q25 results fell short of its and consensus full-year forecasts, attributing it to lower-than-expected revenue growth and softer-than-anticipated EBITDA margin recovery.

• Excess Capacity: HLIB also points to excess capacity in the supply chain as a factor likely to affect equipment demand in the near term

⚠ Overvaluation concerns (Alpha Spread: 30% overvalued)

⚠ Geopolitical risks (US-China tariffs, supply chain disruptions)

⚠ Excess semiconductor capacity (near-term demand pressure)

4. Analyst Ratings & Price Targets

As of the latest available data, analyst opinions on ViTrox (0097) are mixed, with a consensus leaning towards “Hold” or expressing caution due to valuation and near-term headwinds.

• Consensus & Ratings:

◦ Based on past 6 months’ price targets, there were 4 “BUY” calls and 1 “SELL” call, with 0 “HOLD” calls.

◦ However, more recent reports from April 2025 indicate a more cautious stance, with CIMB Investment Bank Bhd (CIMB Securities) and Hong Leong Investment Bank Bhd (HLIB) both giving ViTrox Corp Bhd a “HOLD” rating.

• Brokerage Target Prices:

◦ Alpha Spread: Wall Street analysts forecast ViTrox stock price to drop over the next 12 months from its 3.66 MYR price. The average 1-year price target is 3.05 MYR, with a low forecast of 1.72 MYR and a high forecast of 4.2 MYR. This implies a 17% downside from the 3.66 MYR price at the time of their analysis.

◦ i3investor: Based on past 6 months, the Average Target Price is 4.01 MYR (against a Last Price of 3.61 MYR), indicating an upside of +0.40 MYR (11.08%).

◦ CIMB Securities: Maintained an unchanged target price of RM3.00.

◦ HLIB: Lowered its target price to RM2.65 from RM3.13.

| Brokerage | Rating | Target Price (MYR) | Upside/Downside |

|---|---|---|---|

| CIMB | HOLD | 3.00 | ▼18% |

| HLIB | HOLD | 2.65 | ▼28% |

| Alpha Spread | SELL | 2.55 (Intrinsic) | ▼30% |

| i3investor | BUY | 4.01 (Avg. Target) | ▲11% |

5. Investment Decision Summary

Buy Arguments:

• Strong Earnings Rebound: ViTrox reported a significant year-on-year surge in net profit by 40.2% and profit before tax by 45.4% in 1Q25, marking its first quarterly earnings growth since 4Q22.

• Demand Recovery: The growth was driven by a recovery in demand for Machine Vision System (MVS) and Automated Board Inspection (ABI) segments.

• Improving Profitability: Evident margin recovery with EBITDA margin expanding by 5.7 percentage points to 22.8%.

• Positive Long-Term Sector Outlook: The semiconductor sector has a strong long-term outlook, fueled by demand in generative AI, 5G, high-performance computing, medical devices, aerospace, and electric vehicles.

• Improving Book-to-Bill Ratio: An increase to 1.3x from 1.1x signals stabilizing demand for the company’s products.

• Strategic Investments: ViTrox continues to invest in R&D to strengthen its leadership and capitalize on emerging opportunities.

• Tax Incentives: The company benefits from a pioneer status tax incentive until June 2025, contributing to a lower effective tax rate.

Cautionary Factors:

• Quarter-on-Quarter Decline: Despite strong year-on-year growth, 1Q25 revenue and profit before tax saw a marginal quarter-on-quarter decline.

• Analyst Expectations: 1Q25 results fell short of HLIB’s full-year forecasts, indicating potential challenges in meeting higher expectations.

• Persistent Headwinds: Concerns remain regarding ongoing demand headwinds and margin pressure.

• External Risks: Geopolitical tensions, trade disputes (especially US-China tariffs), and excess capacity in the supply chain are seen as factors that could weigh on capital spending and equipment demand in the near term.

• Valuation Concerns: The stock trades above its 10-year average P/E ratio, and an intrinsic value analysis suggests it is overvalued by 30%. The average Wall Street target price indicates a potential downside from its current market price.

✅ Buy Arguments

- Strong YoY earnings rebound (+40% net profit)

- Margin expansion (EBITDA +5.7 ppts)

- Long-term semiconductor growth (AI, EVs, 5G)

⚠ Cautionary Factors

- Overvalued (P/E 42.6x vs. 10-yr avg.)

- QoQ revenue decline (-5.2%)

- Geopolitical & trade risks

📌 Actionable Insight

- Short-term: Wait for better entry (targets suggest 17-30% downside).

- Long-term: Strong sector tailwinds but monitor demand recovery & valuation.

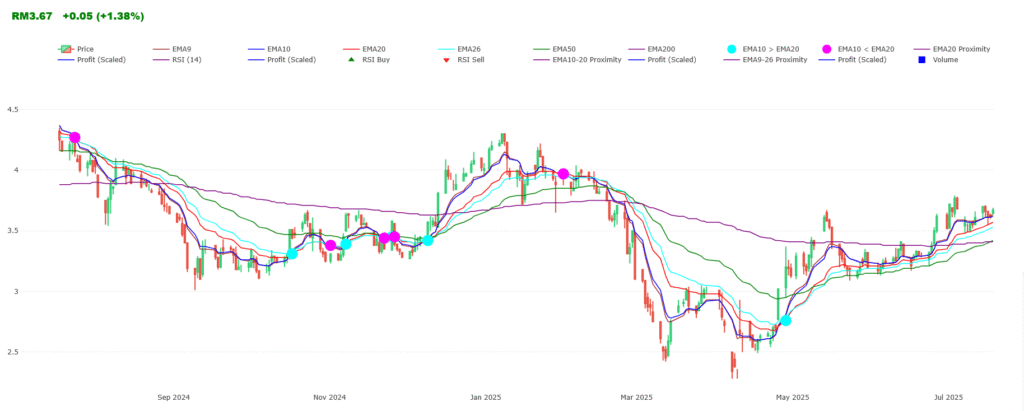

Vitrox chart analysis with back-tested strategies.

Disclaimer: This report is compiled solely based on the provided source excerpts for informational purposes and discussion. It does not constitute financial advice. Investment decisions should be made after conducting thorough personal research and consulting with a qualified financial advisor.