Samaiden Group Berhad (KLSE: SAMAIDEN) is an investment holding company that provides engineering, procurement, construction, and commissioning (EPCC) services primarily for solar photovoltaic (PV) systems and power plants, as well as biomass and biogas power plants, across Malaysia, Singapore, and Cambodia.

1. Company Snapshot

| Metric | Description |

| Core Business | Investment holding company and EPCC service provider focusing on renewable energy (RE) and environmental sectors. |

| Key Services | EPCC of solar PV systems, power plants, and biomass/biogas facilities. Also sells electricity generated through own solar PV facilities (Solar PV Investment segment). |

| Geographic Exposure | Malaysia, Singapore, and Cambodia. |

2. Q4 FY2025 Financial Performance

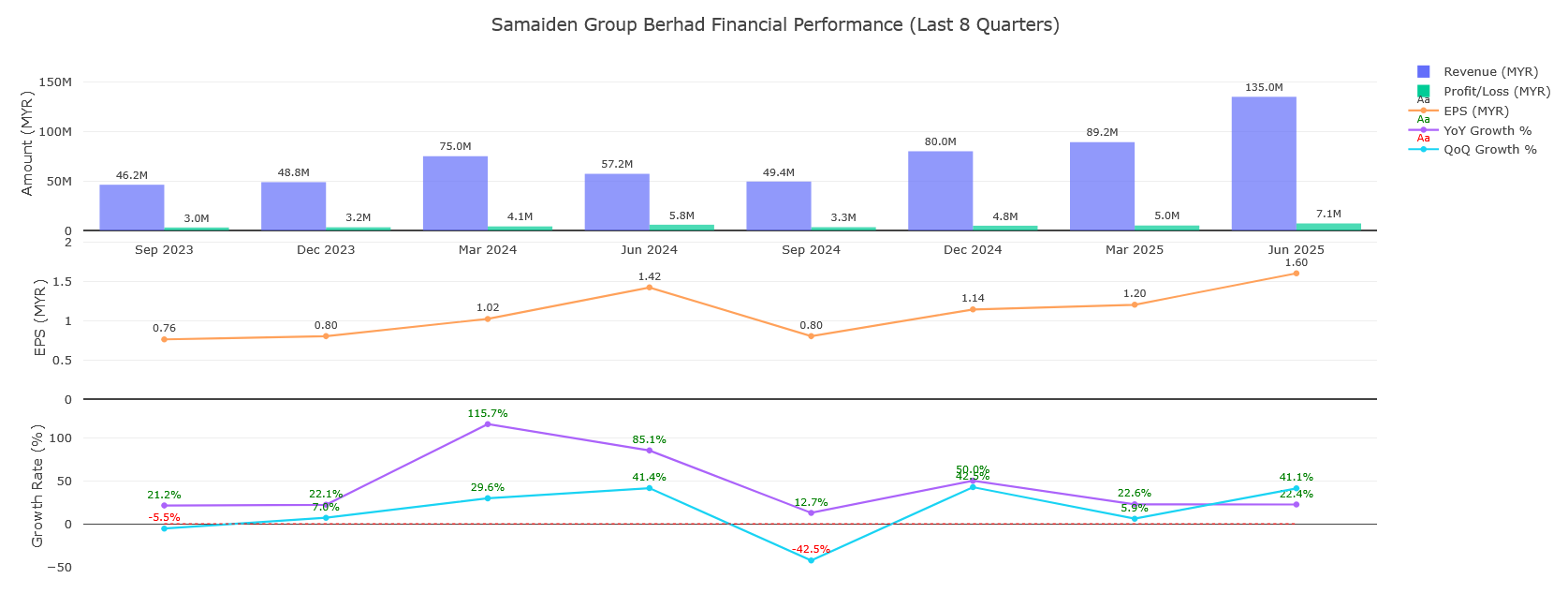

The financial results cover the quarter and year ended June 30, 2025.

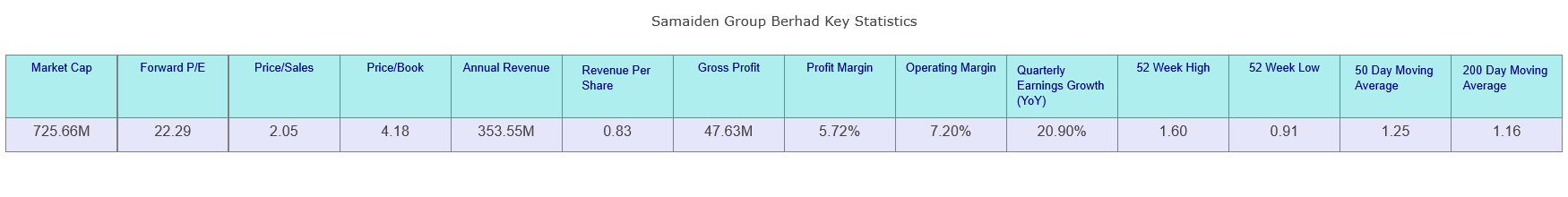

| Metric | Q4 FY2025 (RM ‘000) (30.06.25) | Q4 FY2024 (RM ‘000) (30.06.24) | Change |

| Revenue | 134,950 | 57,234 | +135.8% |

| Gross Profit | 19,140 | 13,051 | +46.6% |

| Profit Before Taxation (PBT) | 8,389 | 8,103 | +3.5% |

| Profit After Taxation (PAT) | 7,079 | 5,806 | +21.9% |

| Basic EPS (Sen) | 1.60 | 1.42 | +12.7% |

Quarterly Performance Review: For the individual quarter, revenue surged significantly by 135.8% to RM134.95 million. This substantial revenue growth was attributed primarily to the continued progress in the execution of the Corporate Green Power Programme (CGPP) projects. However, the growth in PBT (3.5%) lagged behind the revenue increase, reaching RM8.389 million. The discrepancy was partially impacted by an impairment of financial assets amounting to RM5.121 million recognized during the quarter.

Full Year (YTD FY2025) Performance: For the full financial year, the Group reported revenue of RM353.55 million, an increase of 55.6% compared to the previous year. PBT increased by 17.9% to RM25.88 million. This overall improvement was driven by the completion and commencement of large-scale solar projects, specifically the CGPP projects.

3. Growth Drivers & Risks

| Factor | Description |

| Opportunities: Strong Order Book & Pipeline | As of June 30, 2025, the outstanding order book was RM368.2 million. Subsequently, analysts noted the order book had reached a record high of RM699 million. Key recent wins include a RM290 million LSS5 contract for a 95MW plant in Hilir Perak and a RM45 million EPCC contract for a 9.99MWac LSSPV plant in Kulim, Kedah. |

| Opportunities: Diversification & Stable Revenue | Samaiden secured 3 bioenergy projects (biomass/biogas) under the Feed-in Tariff (FiT) 2.0 program, collectively contributing over 18MW capacity. These projects enhance diversification and are expected to establish stable, long-term revenue streams. The Group also signed a 21-year Power Purchase Agreement (PPA) with TNB for a 99.99 MWac solar facility in Kelantan. |

| Opportunities: Policy Tailwinds (BESS/NETR) | The National Energy Transition Roadmap (NETR) aims for 35% RE installed capacity by 2030 (up from 29%). Government initiatives mandate the incorporation of Battery Energy Storage Systems (BESS), including a 400MW BESS auction and requirements for RE developers to incorporate BESS, which benefits the Group by transforming intermittent generation into dispatchable supply. |

| Risks: High Valuation | As of mid-October 2025, the stock was trading at a Price-to-Earnings (P/E) ratio of 36.5x, significantly higher than the median for Malaysian companies (under 14x). This high valuation reflects strong market expectations for persistence in strong earnings growth, forecasted at 22% annually over the next three years. |

| Risks: Material Litigation | The Group is involved in ongoing material litigation, including arbitration and adjudication proceedings against Ditrolic Sdn Bhd concerning Work Packages 3 and 4. Hearing dates for the arbitration were fixed for September and November 2025. An appeal case with Q Horizon Sdn Bhd is also scheduled for hearing on October 3, 2025. |

| Risks: Impairment | The Group recognized a material impairment of financial assets totaling RM6.321 million during the full financial year ended June 30, 2025. |

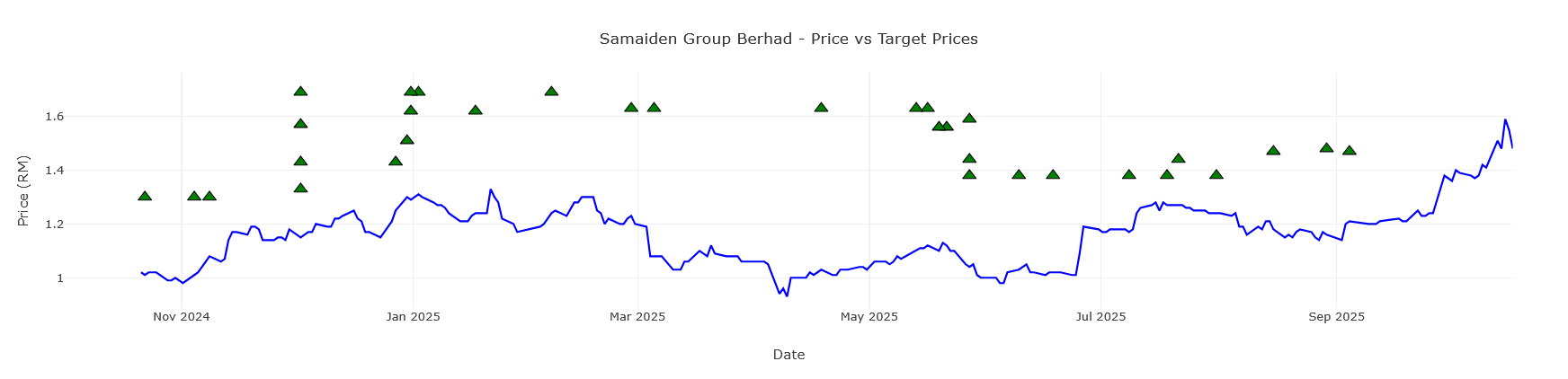

4. Analyst Ratings & Price Targets

Analyst consensus is overwhelmingly positive, with all seven research houses covering the stock maintaining a ‘Buy’ recommendation. The strong earnings outlook is contributing to the high P/E ratio.

| Brokerage | Rating | Target Price (MYR) | Key Commentary |

| Kenanga | Outperform | 2.08 (Street High) | Investors underestimate growth potential; execution recovery viewed as a rerating catalyst. |

| MIDF Research | BUY (Reiterated) | 1.59 | Key beneficiary of CGPP, LSS5, and future RE schemes. |

| TA Research | BUY (Maintained) | 1.38 | Strong order book, net cash position, and project pipeline. |

| RHB Investment Bank | BUY (Reiterated) | 1.44 | Strengthened position due to new bioenergy projects (FiT 2.0). |

5. Technical Outlook (As of October 17, 2025)

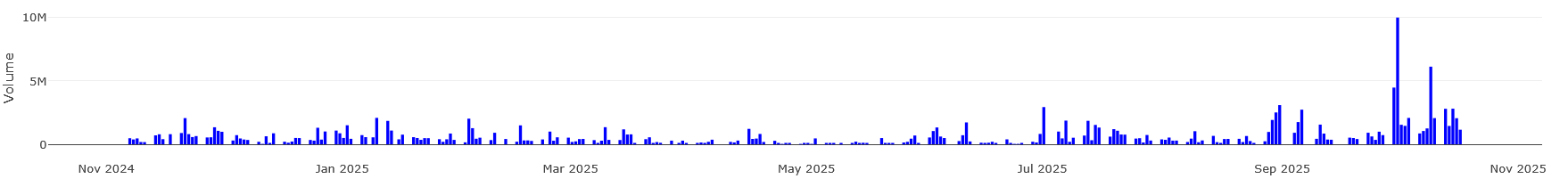

The stock has experienced significant volatility and upward movement, posting a 31% gain in the month leading up to mid-October 2025. The analysis below uses the closing price of RM1.48 as of October 17, 2025.

| Indicator | Value / Status | Interpretation |

| Close Price | 1.48 | Current trading price. |

| SMA50 / SMA200 | 1.2642 / 1.16995 | Golden Cross Confirmed (SMA50 > SMA200). Long-term bullish trend. |

| Price vs. EMAs | Above EMA20 (1.40), EMA50 (1.31), EMA200 (1.19) | Price is strongly supported above key moving averages, indicating a robust short- and long-term uptrend. |

| RSI (Strength) | 62.149 | Neutral/Strong. Momentum is strong but not yet technically overbought (>70). |

| MACD vs. Signal | MACD (0.0772) > Signal Line (0.0649) | Bullish Crossover confirmed, supporting sustained upward momentum. |

| Volume Confirmation | Price surge (31%) supported by robust trading volume. | Recent price movement is confirmed by buying interest. |

Analysis Summary

1. Trend Direction: The stock is in a Strong Uptrend. The confirmed Golden Cross (SMA50 above SMA200) signals major long-term bullish strength. The price (1.48) sitting above the EMA20, EMA50, and EMA200 confirms the short- and mid-term trends are also firmly positive.

2. Momentum & Strength: Momentum is Bullish. The MACD is crossing above its Signal Line, suggesting accelerating upward pressure. The RSI (62.15) indicates strong buying interest but remains below the overbought threshold (70), suggesting capacity for further upside before a technical pullback is warranted.

3. Volume: The technical price increases are confirmed by high volume, especially around the major recent surge.

6. Investment Decision Summary

Samaiden presents a compelling case supported by both strong fundamentals and bullish technical indicators.

Bullish/Buy Arguments:

✅ Record Earnings Visibility: The Group achieved a 55.6% YTD revenue increase and operates with a record-high order book (RM699 million), providing excellent earnings visibility through major contracts like LSS5 and CGPP.

✅ Fundamental Trend: The entire RE sector benefits from accelerated government roadmaps (NETR) and new market opportunities (BESS, FiT 2.0 bioenergy projects).

✅ Technical Alignment: The simultaneous confirmation of a Golden Cross, price stability above major EMAs, and a bullish MACD crossover suggests the recent strong performance is structurally supported.

Cautionary Factors & Risks:

⚠️ Extreme Valuation: The P/E ratio of 36.5x is highly elevated. This means the market has already priced in the expected strong earnings growth (22% per year forecast). If the Group fails to execute projects rapidly or margins fall due to cost pressures or impairment charges (as seen in Q4 FY2025), a severe price correction could occur.

⚠️ Litigation: Ongoing material litigation requires close monitoring as outcomes could affect financial position or market sentiment.

⚠️ Recent Price Surge: The stock jumped 31% in one month. While technically strong, such rapid gains often lead to short-term profit-taking.

Plain Summary for Beginners (Buy / Hold / Sell + Reasoning):

The stock is currently showing strong bullish signals supported by excellent long-term growth prospects in the renewable energy sector.

• Recommendation: Hold / Buy on Pullback.

• Reasoning: If you own the stock, the technical trend confirms that upward movement is likely to continue; hence, Hold. If you do not own the stock, it is trading at a very high price (P/E 36.5x), suggesting it is expensive. For a beginner investor, the prudent approach would be to wait for a pullback (a temporary drop in price) toward a key support level (e.g., the EMA20, currently around RM1.40) before buying, reducing the risk of buying near a temporary peak. The long-term fundamentals remain intact, making it a good candidate for accumulation during market dips.

Disclaimer: This is a technical analysis based on historical price and volume data. It does not constitute financial advice. Always conduct your own research and consider your risk tolerance before making any investment decisions.