Oppstar Holdings Bhd is navigating a complex global semiconductor environment, marked by both challenges and strategic opportunities. The latest news, particularly the partnership with Inventec Corp, presents a mixed picture for its stock price when viewed alongside its recent financial performance and existing projects.

Here’s an overview of Oppstar’s situation and how recent developments might influence its stock:

Current Business Landscape and Outlook

Oppstar is currently facing a challenging global semiconductor landscape due to US-China tariff uncertainties, which have led to increased caution across the supply chain and delays in client decision-making. Engagements with Intel have slowed, and those with Samsung have become more difficult. Its turnkey business remains subdued as clients adopt a “wait-and-see” approach amidst global uncertainties.

Despite these pressures, Oppstar remains cautiously optimistic about a moderate business recovery. The post-silicon services segment is gaining traction, particularly in verification-related work. The company is also experiencing increased engagement from regional clients, especially in Taiwan and Japan. Oppstar is targeting to break even or return to profitability by its financial year ending March 31, 2026 (FY26), supported by a rolling order book of RM10 million to RM15 million and improving utilization of its design engineering team.

The ARM Project

A significant initiative for Oppstar is a telecommunications-related chip design project with ARM, specifically under the Compute Subsystems (CSS) initiative, progressing with a Taiwanese technology firm. Technical discussions for this project are approximately 75% complete. While Oppstar has registered interest with Malaysian authorities, formal proposal submission awaits finalized technical details. A crucial hurdle for the project’s success is securing a local telecommunications partner for trial deployment and testing. Management identifies commercialization as the most significant challenge, citing a perceived lack of sales and business development capabilities among local players to scale beyond prototype stages. Despite recent leadership changes, the ARM project is expected to continue due to the Malaysian government’s strategic commitment to the National Semiconductor Strategy (NSS), which aims to shift Malaysia’s semiconductor ecosystem towards intellectual property (IP) creation and front-end chip design.

Recent Financial Performance

Oppstar’s First Quarter 2026 (1Q 2026) financial results, released on August 27, 2025, showed a net loss of RM4.05 million, a significant decrease from a RM2.10 million profit in 1Q 2025. Revenue was RM7.96 million, down 41% from 1Q 2025, and the company reported a RM0.006 loss per share, compared to a RM0.003 profit in 1Q 2025. Looking ahead, revenue is forecast to grow 16% per annum on average during the next two years, surpassing the 9.0% growth forecast for the Semiconductor industry in Malaysia.

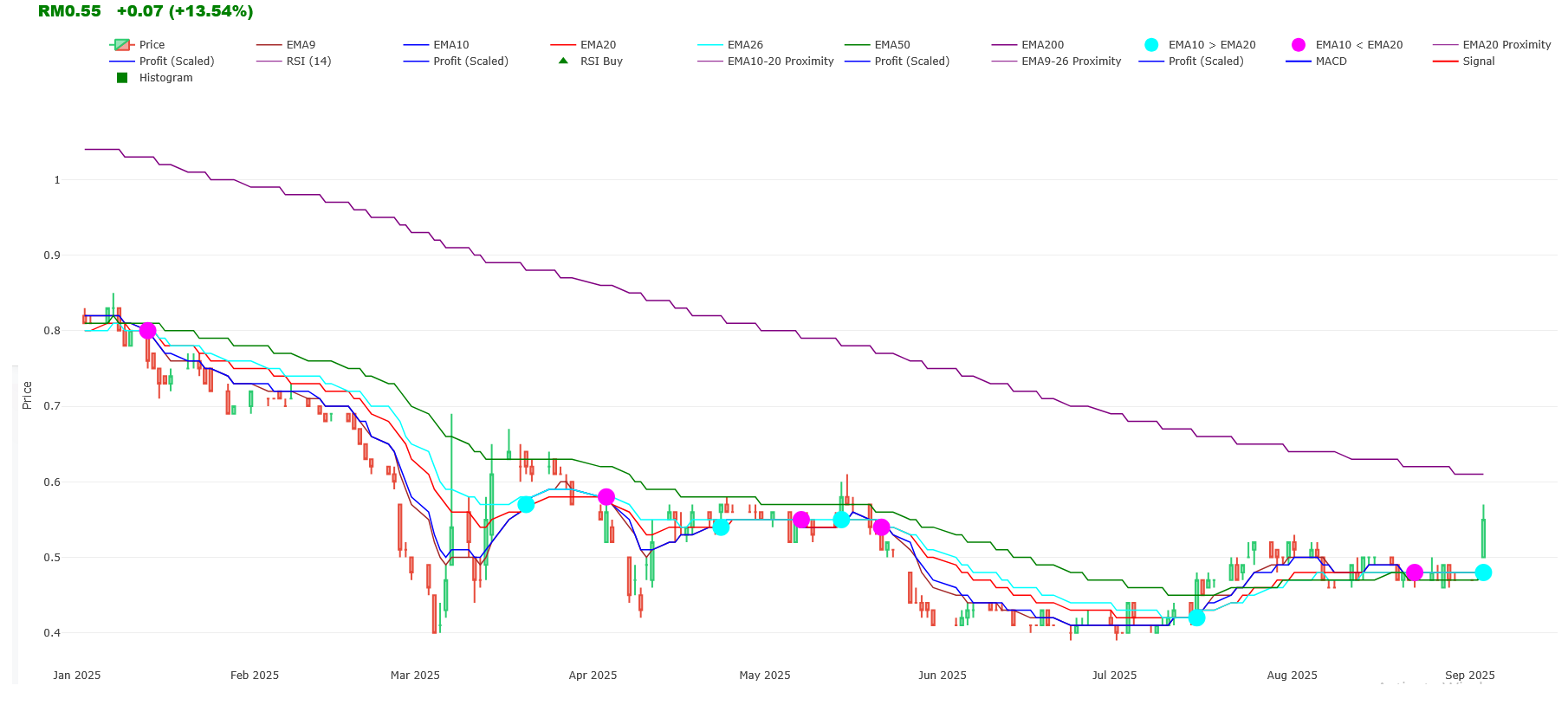

Despite Q1’s challenging result, the stock’s closing price on August 27 was RM0.485. Interestingly, the shares were reported to be up 1.0% from a week prior as of August 27. The technical data for the week leading up to August 27 shows a slight recovery from an August 21-22 low of RM0.465 to RM0.485 on August 27, supporting this observation.

Latest News:

Partnership with Inventec Corp On September 2, 2025, Oppstar announced a significant partnership with Taiwan-listed Inventec Corp to jointly develop a next-generation artificial intelligence (AI) processing chip. This collaboration involves two Memoranda of Understanding:

• Under the first MOU, Oppstar and its subsidiary AIRIS Labs Sdn Bhd will provide IC design expertise and engineering resources, while Inventec will offer system integration capabilities and market access. Inventec’s unit, AsicAI Co Ltd, will lead the architecture design using its proprietary neural processing unit technology.

• The second MOU, between AIRIS Labs and AsicAI, will lead to the formation of a joint venture company for the project. Both agreements also allow the parties to explore participation in Malaysian government initiatives, including ARM Ltd’s compute subsystem programme, to leverage incentives, technical support, and ecosystem resources. Oppstar believes this collaboration will provide greater synergy and business sustainability through expanding its presence and strengthening its profile.

Impact on Stock Price

1. Positive Sentiments from AI Partnership: The partnership with Inventec for next-generation AI chips is a strategically positive development for Oppstar. AI is a high-growth sector, and this move positions Oppstar to capitalize on future demand by leveraging its IC design expertise with Inventec’s system integration and market access. The ability to jointly explore participation in the ARM compute subsystem program through this partnership could also enhance its existing ARM project efforts and potentially unlock further government support and incentives. On the day of the announcement (September 2), Oppstar’s shares finished half a sen or 1.05% higher, and were up 1.0% from a week ago as of August 27, suggesting an initial positive market reaction to strategic news.

The technical data clearly shows the market’s reaction to this news:

• On September 1, 2025, the closing price was approximately RM0.475.

• On September 2, 2025 (the day of the announcement), Oppstar’s shares finished half a sen or 1.05% higher, closing at RM0.48. The trading volume for the day was 1,057,900. This indicates an immediate, albeit modest, positive market sentiment towards the news.

• On September 3, 2025 (the day after the announcement), the stock experienced a more substantial surge, closing at approximately RM0.545. This significant increase was accompanied by a very high trading volume of 13,172,900, suggesting strong investor interest and positive re-evaluation following the news.

2. Addressing Commercialization Challenges: By partnering with Inventec, which offers “system integration capabilities and market access”, Oppstar might mitigate the commercialization hurdles it previously identified for projects like the ARM initiative. This partnership could provide the necessary channels to scale beyond prototype stages for future chip designs.

3. Financial Performance Concerns: Despite the strategic upside of the Inventec partnership, the company’s recent financial performance remains a concern, with a significant net loss and revenue decline in 1Q 2026. Investors will likely scrutinize whether these strategic initiatives can translate into improved profitability and revenue growth in the short to medium term to meet its FY26 break-even target.

4. Analyst Outlook: Kenanga Research has maintained a “MARKET PERFORM” rating on Oppstar with an unchanged target price of RM0.50, based on a 36x FY26F PER. This valuation includes a 10% discount compared to peers, accounting for Oppstar’s smaller scale and more limited capabilities. It is important to note that this report was published before the Inventec partnership announcement, so a re-evaluation by analysts might occur.

5. Market Volatility: Oppstar’s counter has fallen over 41% year-to-date, indicating significant market volatility. While the Inventec partnership provides a strong future growth narrative, the market will likely balance this with current financial realities and the time it takes for these collaborations to yield substantial revenue and profit.

6. National Semiconductor Strategy Alignment: The Malaysian government’s strategic commitment to the National Semiconductor Strategy (NSS), which aims to shift towards intellectual property (IP) creation and front-end chip design, provides a supportive ecosystem for Oppstar’s initiatives, including the ARM project and potentially the new AI chip development. This government backing could further enhance investor confidence.

In summary, the Inventec partnership is a significant positive step for Oppstar, aligning it with the high-growth AI sector and potentially addressing its commercialization challenges. This could lead to a more optimistic long-term outlook for the stock. However, the market will need to see concrete results and a turnaround from its recent net losses for a sustained positive impact on its stock price. The potential synergy and government initiatives explored through this new venture could be key catalysts for its future performance