1. Company Snapshot

Business Overview:

- Core Operations: Civil engineering construction, property development.

- Key Markets: Malaysia, Australia, Taiwan, Singapore, Qatar.

- Growth Sectors: Renewable energy (Australia), data centers.

2. Q3 2025 Financial Performance

Key Metrics

| 3QFY25 (RM’000) | 3QFY24 (RM’000) | Change | 9MFY25 (RM’000) | 9MFY24 (RM’000) | Change | |

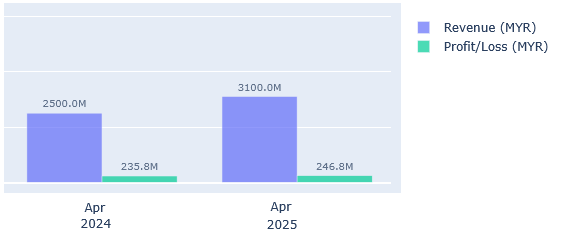

| Revenue | 3,089,570 | 2,490,081 | +24% | 11,127,810 | 8,625,531 | +29% |

| Total Group Revenue (incl. JVs) | 3,249,841 | 3,797,863 | -14% | 11,451,268 | 10,010,049 | +14% |

| Profit Before Tax | 280,819 | 268,881 | +4% | 810,770 | 748,235 | +8% |

| Profit Attributable to Owners of the Company | 246,836 | 235,796 | +5% | 671,078 | 639,640 | +5% |

| Basic EPS (sen) | 4.30 | 4.26 | +1% | 11.81 | 11.72 | +1% |

Highlights

• Quarterly Revenue (Group, including JVs) decreased by 14% to RM3.25 billion from RM3.80 billion in the corresponding quarter last year. This decrease is primarily attributed to the absence of a large, one-off lumpy revenue recognition from a Singapore property project in the previous year. Excluding this specific revenue, the group’s quarterly revenue actually grew by 9%.

• Quarterly Net Profit (attributable to owners) increased by 5% to RM246.8 million compared to RM235.8 million in 3QFY24. This profit growth was driven by stronger domestic construction earnings and overseas property earnings21.

• Domestic construction earnings nearly tripled to RM104 million in 3QFY25 from RM39 million in 3QFY24, contributing significantly to the group’s performance. Domestic jobs now account for 41% of the overall RM35 billion construction order book, up from 28% last year.

• Data centre investments are beginning to yield positive returns, contributing meaningfully to the engineering division’s pre-tax earnings.

• The property segment’s quarterly revenue and net profit decreased by half and one-third respectively due to the absence of the lumpy Singapore property project results. However, excluding this lumpy impact, property revenue grew 31% and net profit grew 148%, largely due to strong contributions from Quick Turnaround Projects (QTPs), particularly Vietnam’s Eaton Park development.

• For the first nine months (9MFY25), total group revenue (including JVs) increased 14% to RM11.45 billion and net profit rose 5% to RM671.1 million, driven by stronger contributions from domestic construction projects.

• Property sales for 9MFY25 increased by 10% to RM2.6 billion (compared to RM2.3 billion last year), spearheaded by several QTPs in Vietnam.

• The Board of Directors proposed a second interim dividend of 5 sen per ordinary share for 3QFY25, bringing the total year-to-date dividend to 10 sen per share, which is 25% higher than the previous year’s 8 sen.

3. Growth Drivers & Risks

Opportunities

- Strong and Diversified Order Book: RM35bn order book (construction) + RM7.7bn unbilled property sales.

- Data centers: Port Dickson project (RM1.01bn contract; potential RM16–18bn pipeline). This site has the potential to host 8-9 data centers, translating to MYR16 billion to MYR18 billion in potential contracts over the next 4-5 years.

- Significant Overseas Expansion:

- New Zealand: Gamuda, as part of the Together North consortium, has been shortlisted for the Northland Corridor Highway (NCH) project (Warkworth to Te Hana section), estimated to cost NZD2.9 billion to NZD3.8 billion. The preferred bidder is expected by early CY26, with contract award by mid-CY26.

- Australia: Gamuda has three other shortlisted infrastructure projects in Australia and is involved in Early Contractor Involvement (ECI) for various renewable energy projects worth at least AUD3 billion. The group’s projects include Sydney Metro West (79% complete), Coffs Harbour Bypass (66% complete), M1 Motorway Extension (66% complete), and Goulburn River Solar Farm (EPCM contract worth AUD626 million).

- Taiwan: Secured its sixth and seventh infrastructure projects, including the Kaohsiung MRT Metropolitan Yellow Line Civil Engineering, Package YC01 (RM3.45 billion) in October 2023 and the Xizhi Donghu MRT project (RM4.3 billion) in October 2024. Also awarded a RM520 million contract for a 345kV underground transmission line in March 2025.

Risks

- Slower-than-expected job replenishment/rollouts: This remains a key risk to the sector call.

- Impact of expanded Sales and Services Tax (SST): While manageable, a key downside risk would be if the SST is revised later to cover basic construction materials and residential buildings. Construction services will see a 6% service tax applied to providers exceeding MYR1.5m in annual revenue, though residential buildings, public housing, and business-to-business transactions are exempted. Contractors might factor in the tax for new projects or reprice reviewable contracts.

- Labor shortages: A general risk for the construction sector.

- Scaling down of Data Centre investments into Malaysia: This is identified as a key downside risk for the sector.

- Foreign currency translation losses: The group experienced a net foreign exchange loss of RM386 million in the 9-month period due to a stronger Ringgit Malaysia against overseas assets.

4. Analyst Ratings & Price Targets

- Consensus: Analyst calls indicate a Strong Buy consensus, with 127 BUY ratings, 3 HOLD, and 4 SELL ratings within the past 6 months.

- Avg. Target Price: RM8.04 (+72.9% upside from RM4.65).

- Brokerage Ratings and Price Targets

- RHB-OSK/RHB Research:

◦ Date: June 10, 2025: BUY call with a Target Price of RM5.83.

◦ Date: June 4, 2025: BUY call with a Target Price of RM5.83.

◦ Date: June 17, 2025: Maintained BUY with a new Target Price of MYR5.64 (from MYR5.83), implying a 21.29% upside from the last price of RM4.65. RHB expects 3QFY25 core earnings to be in the MYR230-250 million range.

◦ Date: June 24, 2025: Maintained BUY with a Target Price of MYR5.64, implying a 21.29% upside from the last price of RM4.65. They view Gamuda as deserving of a premium valuation (19.3x FY26F P/E) compared to the Bursa Malaysia Construction Index (14x average 10-year mean P/E) due to its data center capabilities and involvement in Australian RE projects. - Maybank Research:

◦ Date: June 2, 2025: Maintained BUY call with an RNAV-TP of MYR4.9561. They note that while 3QFY25 earnings were trimmed slightly on lower E&C margins, FY7/26E and FY7/27E earnings are little changed. - EPF Activity: The Employees Provident Fund Board (EPF) has been actively acquiring Gamuda shares in early June 2025, increasing its holdings from 13.93% to 14.29% by June 26, 2025

5. Investment Decision Summary

Buy Arguments

• Robust Financial Performance: Despite a lumpy revenue recognition issue from the prior year, Gamuda’s core earnings, particularly from domestic construction, show strong growth.

• Significant Order Book: The group’s RM35 billion construction order book and RM7.7 billion in unbilled property sales provide strong earnings visibility and resilience.

• High-Growth Sector Exposure: Strategic investments and new wins in data centers (significant potential worth MYR16-MYR18 billion), and renewable energy projects in Australia position the company well for future growth.

• Diversified Geographic Footprint: Expansion into lucrative overseas markets like Australia, Taiwan, and New Zealand diversifies revenue streams and reduces reliance on any single market.

• Healthy Balance Sheet: A comfortable net gearing of 45% provides financial stability and capacity for future projects.

• Positive Analyst Sentiment: A strong consensus BUY rating from analysts, with significant upside potential in their price targets.

• Strong ESG Credentials: Improved ESG score and an associated premium add to investment appeal.

Cautionary Factors

• Revenue Volatility: Past “lumpy” revenue recognition from one-off projects can distort headline figures and require careful analysis.

• Economic Headwinds: Potential for slower-than-expected job rollouts and labor shortages could impact project execution and earnings.

• Regulatory Changes: Future expansion of the SST to include basic construction materials or residential buildings poses a downside risk.

• Foreign Exchange Exposure: Significant overseas assets mean that a stronger Ringgit Malaysia can lead to foreign currency translation losses.

Gamuda chart analysis with back-tested strategies.

Disclaimer: This report is compiled solely based on the provided source excerpts for informational purposes and discussion. It does not constitute financial advice. Investment decisions should be made after conducting thorough personal research and consulting with a qualified financial advisor.