Frontken Corporation Berhad (KLSE: 0128) is a Malaysia-based investment holding company operating in the Technology sector, specifically Semiconductors. Through its subsidiaries, Frontken provides surface and mechanical engineering solutions to heavy industries, including Oil and Gas, Power Generation, Semiconductors, and Marine. Key services include thermal spray coating, precision cleaning, welding, machining, plating, and abrasive blasting.

1. Company Snapshot

Core Business: Surface/mechanical engineering for semiconductors (60%+ revenue from Taiwan), O&G, power generation.

Key Services: Thermal spray coating, precision cleaning, plating, machining.

Geographic Exposure: Singapore (primary), Taiwan, Malaysia.

2. Q1 2025 Financial Performance

Key Metrics

| Metric | 1Q25 (RM mil) | 1Q24 (RM mil) | Change |

|---|---|---|---|

| Revenue | 132.56 | 140.52 | -5.66% |

| Net Profit | 31.07 | 30.05 | +3.37% |

| Operating Margin (Taiwan) | 44% | 44% | Stable |

Frontken’s financial results for the first quarter ended March 31, 2025 (1Q25) were announced on May 5, 2025.

Revenue Decline: Despite the profit increase, revenue decreased by 5.66% to RM132.56 million in 1Q25, down from RM140.52 million in 1Q24. This revenue drop was attributed mainly to lower contributions from the oil and gas (O&G) segment. The weaker O&G performance resulted from fewer operational days and the absence of certain one-off projects present in 1Q24. The company also mentioned that the Lunar New Year and Ramadan periods temporarily affected operations and service schedules.

Margin Expansion: Positively, the company saw a marginal expansion in group EBIT margins by 0.2 percentage points year-on-year, supported by improved operational efficiencies. The Taiwan segment, crucial for its semiconductor business, achieved a record high operating margin of 44% in 1Q25, comparable to 1Q24, as activities at its P2 Kaohsiung plant ramped up.

Highlights:

- Semiconductor segment drove profit growth (record 44% margin in Taiwan).

- O&G revenue drop: Fewer operational days + Lunar New Year/Ramadan impact.

- No dividend declared for 1Q25.

3. Growth Drivers & Risks

Opportunities

- AI Boom: Demand surge for advanced chips (TSMC, Nvidia, AMD exposure).

- Expansion: New Tainan Plant 3 (RM23M land acquisition), Arizona collaboration.

- O&G Recovery: Expected rebound in later quarters.

Risks

- Industry Recovery Pace: Prolonged semiconductor industry recovery.

- Customer Concentration: Being heavily reliant on a leading foundry in Taiwan.

- Geopolitical Tensions and Tariffs: Ongoing trade war and evolving tariff policies.

4. Analyst Ratings & Price Targets

Consensus: Strong Buy (9 analysts).

| Brokerage | Rating | Target Price (MYR) | Upside |

|---|---|---|---|

| Maybank | BUY | 5.10 | +28% |

| Phillip Capital | BUY | 4.50 | +13% |

| Average Target | – | 4.51 | +13% |

• Maybank Research: Maintains a “BUY” rating and a price target of MYR5.10

This target is pegged to 43x FY26E PER, at +0.5 standard deviation to its mean. Maybank maintains Frontken as its top Malaysian Semiconductor pick due to its exposure to a leading foundry in Taiwan.

• Phillip Capital: Maintains a “BUY” rating but revised its 12-month price target downwards to RM4.50 (from RM4.68)

This revision accounts for the weaker 1Q25 performance and is based on rolling forward the valuation horizon but lowering the target PE multiple to 40x (from 45x), based on an updated 5-year mean PE.

The consensus indicates a significant potential upside from the current price (around RM3.99 as of recent data)

The Employees Provident Fund Board (EPF), a substantial shareholder, has been actively trading Frontken shares in late May and early June 2025. Records show frequent acquisitions and disposals of shares. For instance, on June 5th, 2025, EPF acquired shares but also disposed of shares on June 4th and May 30th. The company has also bought back shares previously at prices between RM2.76 to RM3.29.

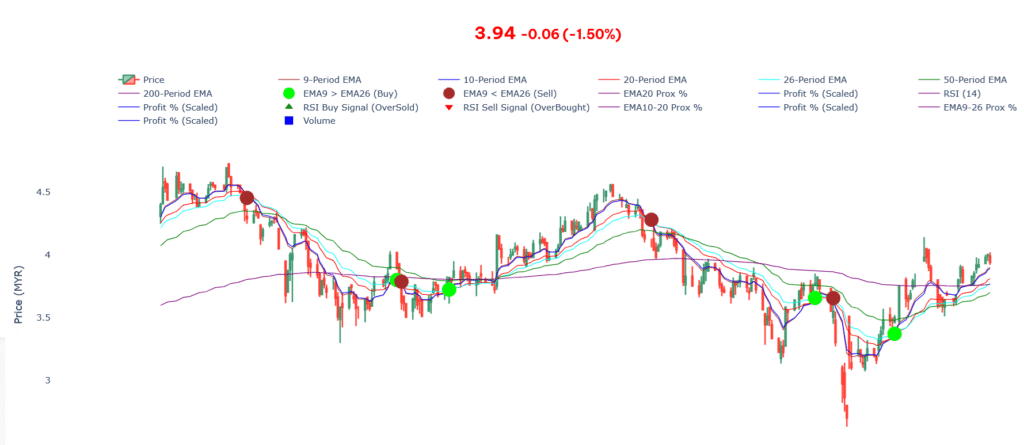

5. Technical Outlook (June 2025)

Bullish Breakout:

- Resistance broken at MYR 3.90.

- Next targets: MYR 4.15 → MYR 4.35.

- Stop-loss: Below MYR 3.70.

6. Investment Decision Summary

Buy Arguments

✅ Semiconductor margin strength (44% in Taiwan).

✅ AI-driven demand tailwinds (TSMC collaboration).

✅ Analyst targets imply 13–28% upside.

Cautionary Factors

⚠️ Revenue miss in 1Q25 (O&G weak).

⚠️ Geopolitical/tariff risks (US-China tensions).

⚠️ Customer concentration (TSMC reliance).

Actionable Insight:

- Entry: Near current price (~MYR 3.99) with stop-loss at MYR 3.70.

- Exit: At upper target range (MYR 4.50–5.10) or if key support breaks.

Frontkn chart analysis with back-tested strategies.

Disclaimer: This report is compiled solely based on the provided source excerpts for informational purposes and discussion. It does not constitute financial advice. Investment decisions should be made after conducting thorough personal research and consulting with a qualified financial advisor.