Inari Amertron Berhad (KLSE: INARI, 0166) is a Malaysia-based investment holding company primarily engaged in outsourced semiconductor assembly and test services (OSAT) and electronics manufacturing services (EMS) industries2. The electronic manufacturing services segment contributes the majority of its total revenue. Inari’s latest quarterly results, for the period ended 31 March 2025, were announced on 20 May 2025

1. Company Snapshot

Core Business:

- Investment holding with primary engagement in Outsourced Semiconductor Assembly & Test (OSAT) and Electronics Manufacturing Services (EMS).

- Major revenue from Singapore (~90%), followed by Malaysia & China.

Key Risks:

- Customer concentration (~90% from one client).

- Geopolitical & forex risks.

- China subsidiary startup losses (RM4.95M in Q3).

2. Financial Performance (Q3 FY2025 vs. Q3 FY2024)

Revenue & Profit Trend (YoY & QoQ)

(RM in millions)

| Metric | Q3 FY2025 | Q3 FY2024 | YoY Change | Q2 FY2025 | QoQ Change |

|---|---|---|---|---|---|

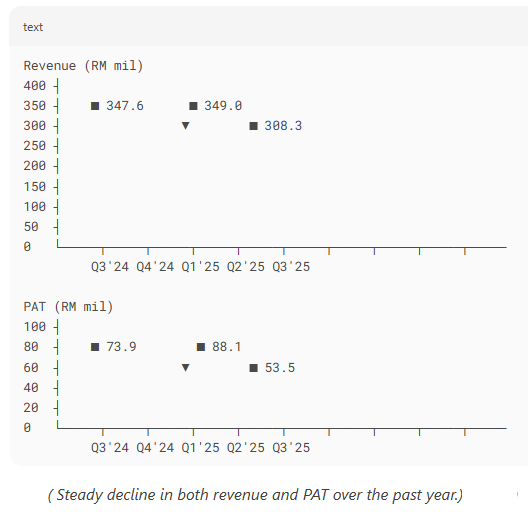

| Revenue | 308.3 | 347.6 | ▼11.3% | 349.0 | ▼11.7% |

| PAT | 53.5 | 73.9 | ▼27.5% | 88.1 | ▼39.2% |

| EPS (sen) | 1.46 | 1.97 | ▼25.9% | – | – |

📉 Key Observations:

- Double-digit decline in revenue & profit due to lower volume loading and forex losses.

- China subsidiary drag: RM4.95M startup losses (ex-China, PAT decline would be -20.9% YoY).

Revenue & Profit Trend (Last 5 Quarters)

(Bar Chart – RM in millions)

3. Growth Drivers vs. Risks

Opportunities

✅ AI-driven semiconductor demand (data comms growth).

✅ Smartphone market recovery (+1.5% YoY shipments in Q1 2025).

✅ China expansion (long-term growth potential).

Risks

⚠️ Single customer dependency (~90% revenue).

⚠️ Macro slowdown (IMF forecasts 2.8% global GDP growth in 2025).

⚠️ Geopolitical & tariff risks (US-China trade tensions).

4. Analyst Ratings & Price Targets

Consensus Forecasts

| Source | Avg. Target (MYR) | Upside | Sentiment |

|---|---|---|---|

| Wall Street | 2.48 | +32% | Bullish |

| i3investor | 3.24 | +73% | Strong Buy |

| Macquarie | 1.35 (Neutral) | -28% | Cautious |

📊 Insider Activity (June 2025):

- EPF (Govt Fund): Bought 6.8M shares (Bullish signal).

- KWAP (Pension Fund): Sold 340K shares (Minor bearish).

5. Technical Outlook (June 2025)

- Current Price: MYR 1.87 (-4.1% today).

- 52-Week Range: MYR 1.42 – 4.03.

- Support Levels: MYR 1.80 (4-week low).

📉 Short-term Trend: Bearish (Testing lower range).

📈 Long-term Potential: Rebound if semiconductor demand improves.

6. Investment Decision Summary

| BUY Arguments ✅ | CAUTION Factors ⚠️ |

|---|---|

| – AI-driven semiconductor growth | – Revenue & PAT declining |

| – Analyst avg. target: MYR 2.48 (+32%) | – Single-customer risk (~90%) |

| – EPF accumulating shares | – China losses drag earnings |

| – Cheap valuation (P/E ~12x) | – ROE decline (18% → 10%) |

Actionable Insight

- Entry Point: Near MYR 1.80 (4-week low support).

- Exit/Stop-loss: Below MYR 1.42 (52-week low).

- Hold for: AI/5G recovery & China turnaround.

📌 Final Verdict: Neutral-to-Cautious Buy

(High-risk, high-reward play on semiconductor rebound but monitor customer concentration & China losses closely.)

Inari chart analysis with back-tested strategies.

Disclaimer: This report is compiled solely based on the provided source excerpts for informational purposes and discussion. It does not constitute financial advice. Investment decisions should be made after conducting thorough personal research and consulting with a qualified financial advisor.