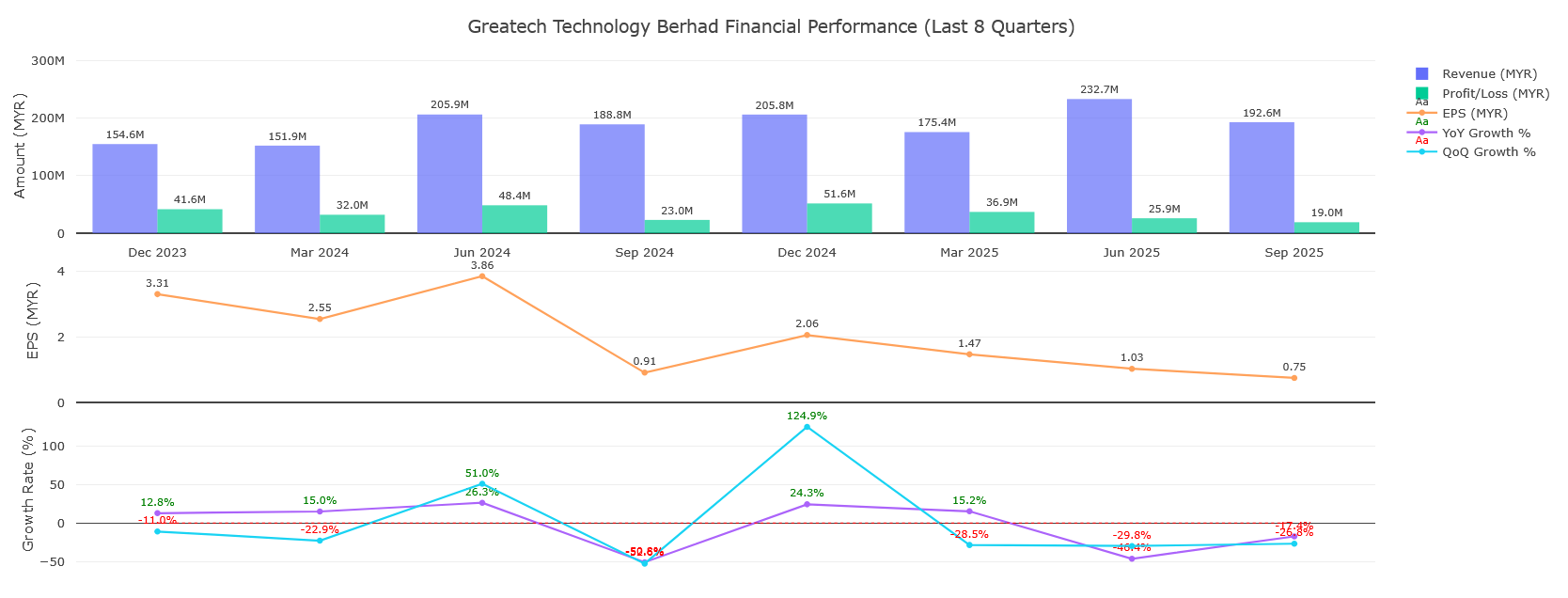

Overview: Greatech Technology Berhad released its unaudited financial results for the third quarter ended September 30, 2025 (3Q2025). The Group reported increased revenue year-on-year (YoY) but experienced a decline in profitability, primarily due to lower product margins, increased operating costs, and staff expenses related to organic growth and strategic acquisitions. Near-term headwinds relating to tariffs and market complexities were flagged, particularly concerning customer decision-making in the US.

——————————————————————————–

Key Financial Highlights

| Description | Current Quarter (30 Sep 2025) (RM’000) | Preceding Year Quarter (30 Sep 2024) (RM’000) | Change (%) |

| Revenue | 192,625 | 188,792 | +2.03% |

| Gross Profit (GP) | 48,723 | 65,779 | -25.93% |

| GP Margin | 25.29% | 34.84% | -9.55 pp |

| Profit Before Tax (PBT) | 27,497 | 28,965 | -5.07% |

| Profit for the Period | 18,971 | 22,954 | -17.35% |

| Basic Earnings Per Share (sen) | 0.75 | 0.91 | -17.58% |

| Proposed/Declared Dividend per share (Subunit) | 0.00 | 0.00 | N/A |

——————————————————————————–

Review of Performance

1. Current Quarter vs. Preceding Year Corresponding Quarter (3Q2025 vs. 3Q2024)

Revenue Growth & Drivers The Group’s revenue for 3Q2025 was RM192.63 million, reflecting an increase of RM3.83 million or 2.03% compared to 3Q2024. This revenue growth was primarily driven by higher revenue recognized from the Production Line System (PLS) of the E-Mobility sector and the Single Automated Equipment (SAE) of the Semiconductor sector. E-Mobility was reported as the largest sales contributor during the quarter, making up 46% of sales.

Profitability and Margin Contraction Profit Before Tax (PBT) decreased by RM1.47 million or 5.07% to RM27.50 million. The resulting PBT margin decreased from 15.34% to 14.27%.

The decline in PBT and margins was primarily attributed to:

1. Lower Gross Profit (GP): GP margin narrowed substantially to 25.29% in 3Q2025 from 34.84% in 3Q2024. The preceding year quarter benefited from revenue recognition tied to the completion of key project installation milestones, which typically carry higher margins. The normalized GP margin (excluding net warranty impact) also decreased significantly (25.72% in 3Q2025 vs. 34.96% in 3Q2024).

2. Higher Operating Costs: PBT declined due to higher employee compensation and benefits expenses, which rose by RM8.04 million. This increase in staff costs stemmed from a higher headcount resulting from both organic expansion and a strategic acquisition made during the year.

Mitigating Factors These pressures were partially offset by a net favourable foreign exchange variance of RM24.70 million compared to 3Q2024, due to the Group’s net foreign exchange position improving from a net loss of RM24.70 million in 3Q2024 to a negligible net gain in the current quarter.

2. Comparison with Immediate Preceding Quarter (3Q2025 vs. 2Q2025)

Revenue Revenue decreased by RM40.11 million or 17.23% compared to the preceding quarter (2Q2025). The higher revenue recorded in 2Q2025 was considered exceptional, driven by elevated delivery volumes for both EV and Solar project manufacturing, supported by accelerated production activities.

Profitability PBT decreased marginally by RM1.43 million. However, the PBT margin improved to 14.27% from 12.43% in 2Q2025. This improvement in PBT margin was mainly due to a marginal net foreign exchange gain resulting from more moderate ringgit movements during the quarter.

The normalized GP margin declined from 28.50% in 2Q2025 to 25.72% in 3Q2025, primarily due to prototyping costs incurred for a new project and higher employee compensation and benefits expenses.

3. Cumulative Period Performance (9M2025 vs. 9M2024)

For the nine months ended September 30, 2025 (9M2025), the Group recorded revenue of RM600.75 million, an increase of 9.92% compared to RM546.54 million in 9M2024. This higher revenue was mainly attributable to the contribution from the newly acquired subsidiary, Greatech Mechatronics (Slovakia) s.r.o. (GMS).

PBT for 9M2025 declined by 14.27% to RM99.38 million (from RM115.92 million in 9M2024). Net profit fell 20.9% to RM81.82 million. The decline was driven by:

1. Higher employee compensation and benefits (increase of RM9.94 million) from increased headcount.

2. A higher net impairment impact on financial assets of RM4.12 million (9M2024 had reflected a reversal).

3. Higher net foreign exchange losses of RM2.74 million compared to 9M2024.

——————————————————————————–

Financial Position and Cash Flow Summary

Statement of Financial Position (as at 30 September 2025)

Total Assets increased to RM1,232,177,000 from RM1,112,267,000 as at 31 December 2024.

Key changes in the statement of financial position include:

• Property, plant and equipment increased to RM435,068,000 from RM387,224,000.

• Intangible assets increased to RM8,101,000 from RM1,810,000.

• Trade and other receivables increased significantly to RM210,443,000 from RM151,360,000.

• Inventories decreased to RM36,291,000 from RM68,919,000.

• Total Liabilities increased to RM238,560,000 from RM202,977,000.

• The Group introduced a Bank overdraft of RM35,640,000 classified under current liabilities (previously nil).

• Net assets per share attributable to owners of the parent stood at RM0.3954 (up from RM0.3621 as at 31 December 2024).

Cash Flow Analysis (9 Months Ended 30 September 2025)

Net cash from operating activities decreased significantly to RM65,236,000 in 9M2025, compared to RM121,852,000 in 9M2024.

Net cash used in investing activities was RM69,568,000. A large portion of this was attributed to the acquisition of a subsidiary, net of cash acquired, amounting to RM49,537,000.

——————————————————————————–

Segmental Information and Corporate Developments

Segmental Reporting: The Group views its operations as a single reportable segment: the sale of automated equipment together with provision of parts and services.

Changes in Group’s Composition: In January 2025, the Company incorporated Greatech Mechatronics (M) Sdn Bhd. On April 7, 2025, the acquisition of the entire equity of Manz Slovakia s.r.o. (subsequently renamed Greatech Mechatronics (Slovakia) s.r.o. or GMS) was completed for a total purchase consideration of €1,000,000 (approximately RM4.66 million). GMS’s principal activity is original design manufacturing. The fair value of net liabilities acquired was RM1,908,000, contributing RM6,547,000 in intangible assets.

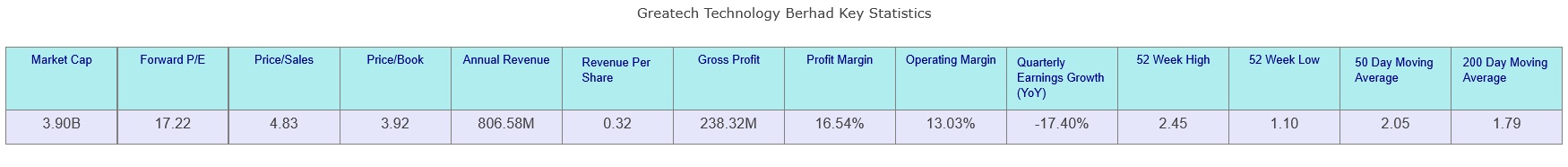

Taxation: The Group’s effective tax rate for the cumulative financial period was 17.67% (higher than 10.82% in 9M2024). This rate was lower than the statutory rate of 24% because a subsidiary, Greatech Integration (M) Sdn Bhd, was granted pioneer status for specific activities related to the designing and manufacturing of production line systems and single automated equipment.

Borrowings: Total borrowings (excluding lease liabilities) stood at RM47,632,000 as of September 30, 2025, including a bank overdraft of RM35,640,000.

——————————————————————————–

Commentary on Prospects and Outlook

Order Book Visibility The Group’s outstanding order book stood at approximately RM697.91 million as of November 19, 2025. This order book provides earnings visibility until the first half of 2027. The order book composition is led by Solar (32%) and Data Centre-related (23%), followed by Semiconductor (16%), E-Mobility (15%), Medical (9%), Pharmaceutical (3%), and Consumer electronics (2%). Management targets an order book of RM1.5 billion for 2026.

Near-Term Headwinds Greatech continues to operate in a healthy demand environment but cautioned on near-term headwinds. Market conditions have become more challenging as tariffs and other complexities continue to cloud customer decision-making, especially across the Americas.

Management expects sequential quarter margins to decline further in 4Q2025 due to higher staff costs (from additional hiring) and expected lay-off redundancy costs related to the Slovakia plant. Margins will also face additional pressure from tariff-related costs, which Greatech is currently negotiating with customers for an appropriate cost-sharing arrangement. Potential delays in client investment decisions are also noted.

Long-Term Strategy and Growth Drivers Despite current headwinds, the Group remains confident in sustaining performance. The long-term outlook remains highly encouraging, driven by structural growth opportunities:

• Key Growth Sectors: Electric-vehicle manufacturing, solar energy, and life sciences.

• Data Center (DC) Opportunities: DC-related work is a positive surprise and is expected to contribute strongly to sales over the next five years, with management targeting a net margin of around 20% in this segment. The Group recently secured a RM160 million data center-related project and is eyeing another RM150 million project in the Southeast Asia region.

• Clean Energy Localization: The ongoing localization of clean-energy supply chains, particularly within the United States, strengthens the strategic relevance of Malaysian equipment suppliers within global ecosystems.

Greatech is proactively managing market fluidity through strategic local sourcing, cost optimisation, and operational discipline. The management’s shift into new sectors reduces reliance on single segments, which is expected to strengthen resilience and facilitate more scalable growth.

Disclaimer: This is a technical analysis based on historical price and volume data. It does not constitute financial advice. Always conduct your own research and consider your risk tolerance before making any investment decisions.