Gamuda Berhad closed its financial year ended July 31, 2025 (FY2025), securing its status as a construction powerhouse by achieving an all-time high net profit of RM1 billion and an unprecedented visibility driven by its massive order book. The impressive results were largely propelled by a significant surge in domestic infrastructure projects and resilient contributions from overseas Quick Turnaround Property Projects (QTPs)

I. Financial Performance: The Billion Ringgit Breakthrough

Gamuda’s FY2025 marks a historical milestone, with profitability crossing the RM1 billion threshold for the first time since the company’s listing in 1992.

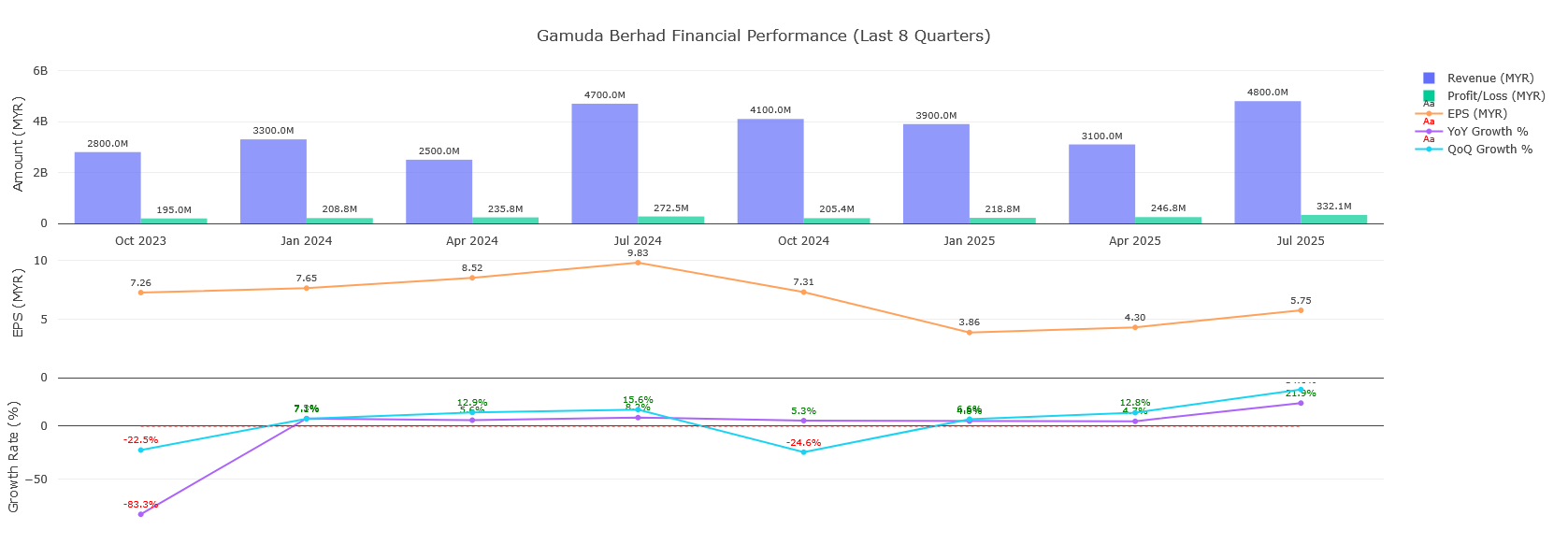

| Metric | 4Q FY2025 (RM’mil) | Variance YoY | FY2025 YTD (RM’mil) | Variance YoY |

| Revenue (Reported) | 4,842.4 | +2.6% / 3% | 15,970.2 | +19.7% / 20% |

| Total Revenue (Including JV) | 4,915.0 | +3% | 16,366.3 | +11% |

| Net Profit (Attributable to Owners) | 332.1 | +21.9% / 22% | 1,003.2 | +10% |

| Core Net Profit | 332.2 | +22.3% | 996.5 | +9.8% |

| Basic EPS (sen) | 5.75 | +17% | 17.61 | +6% |

Key Financial Insights:

1. Record Profitability: Full-year net profit hit RM1.003 billion, a 10% increase from the previous year’s RM912.13 million.

2. Revenue Growth: Total revenue (including the Group’s share of joint ventures’ revenue) rose 11% to a record-breaking RM16.4 billion.

3. 4Q Surge: Quarterly net profit for 4Q FY2025 increased by 22% to RM332 million, primarily due to domestic construction earnings doubling and overseas property earnings jumping 68%.

4. Sequential Momentum: Quarterly earnings in 4Q FY2025 (RM332 million) showed a strong 34% increase compared with the immediate preceding quarter (Q3 FY2025, RM247 million), largely due to stronger contributions from QTPs, notably Vietnam’s Eaton Park.

5. Profit Margin: The overall profit margin for FY2025 stood at 6.3%, a slight decrease from 6.8% in FY2024, driven by higher expenses. However, the Construction division saw improved margins, with PBT margins rising to 6.4% from 5.9% in FY2024.

II. Operational Deep Dive: Construction Drives the Narrative

The Group’s financial success is overwhelmingly attributed to the massive scale-up of its Construction and Engineering division, both domestically and internationally.

A. Construction Division: Unprecedented Orderbook

The construction division delivered record high revenue of RM12.6 billion and net profit of RM626 million in FY2025, reflecting robust YoY growth of 18% and 25%, respectively.

• Orderbook Scale: Gamuda’s construction orderbook reached an all-time-high balance of RM38 billion, following record job wins totaling RM25 billion during the year.

• Domestic Dominance: The uplift was driven by domestic projects, where earnings surged 73% YTD and domestic construction revenue grew by 146%. Domestic jobs now account for 50% (RM19 billion) of the total order book, up significantly from 28% a year ago.

• Data Centre Focus: Data centers are a key revenue stream, contributing 10% of the total order book. Major wins include the RM2.138 billion contract for Hyperscale Data Centres at Eco Business Park V, secured subsequent to the quarter end in August 2025, and enabling works for Port Dickson data centers (RM1.01 billion).

• Progress on Major Projects:

◦ The Sydney Metro West Western Tunnelling Package is 87% complete and on target for overall completion in mid-2026.

◦ Coffs Harbour Bypass project in Australia is 74% complete and tracking well for completion in June 2027.

◦ The core and shell works for the RM1.74 billion hyperscale data centre at Elmina Business Park are 91% complete, ahead of schedule for completion by Q1 2026.

B. Property Division: International QTPs Provide Stability

While overall property sales declined, the underlying strength of the division, supported by international Quick Turnaround Projects (QTPs), remained robust.

• Property Sales: Sales declined 19% to RM4.1 billion in FY2025, falling short of the internal RM5 billion target. This miss was attributed to the timing of delayed approvals for Hanoi projects, with sales expected to be carried forward to FY2026.

• Overseas Growth: Overseas property earnings jumped 68% in 4Q FY2025. Underlying property net profits grew 6% YoY (excluding a lumpy one-off recognition from a fully sold Singapore development in FY2024).

• Vietnam Momentum: The Vietnam QTP, especially Eaton Park, continued to generate robust sales with higher margins, contributing significantly to the quarterly earnings growth. Four of the six towers at Eaton Park are fully sold.

• Earnings Visibility: Resilience is underpinned by a record-high unbilled property sales of RM8 billion, which is expected to contribute steadily to future profit as construction progresses.

III. Financial Health and Capital Management

• Increased Gearing: Strategic investment in land banks (including the newly acquired 336-acre freehold land adjacent to Gamuda Cove) and ongoing development expenditure led to group gearing increasing to 53% from 39% last year. This remains comfortably below the group’s self-imposed ceiling of 70%.

• Borrowings: Total borrowings stood at RM0.13 billion as of July 31, 2025, compared to RM7.81 billion a year prior.

• Dividends: The full-year payout was 10 sen (comprising two interim dividends of 5 sen each on the enlarged share capital base following the 1:1 bonus share issuance). Notably, the dividend payout ratio is conservative at approximately 20%, and a large portion (75% and 76%) of the dividends was elected for reinvestment through the Dividend Reinvestment Plan (DRP).

IV. Outlook and Growth Catalysts for FY2026

Gamuda is poised for significant future growth, with multiple confirmed contracts yet to be fully recognized and an aggressive expansion strategy.

1. FY2026 Earnings Drivers: Next year’s earnings performance is anticipated to be largely driven by the ramping up of newly awarded domestic construction projects (including the Penang LRT – Mutiara Line Phase 1, Ulu Padas Hydroelectric Project, and multiple data centers) and higher contributions from high-margin Vietnam QTPs like Eaton Park.

2. Orderbook Trajectory: Management is confident in securing another RM10 billion in new jobs by the end of Calendar Year 2025, potentially raising the total order book to RM40 billion–RM50 billion by FY2026.

3. Data Centre Pipeline: Data centre tenders remain active and ongoing. Data centers already account for 10% of the current orderbook.

4. Property Target: The property division aims for a higher new sales target of RM5.5 billion for FY2026. This will be supported by launches worth more than RM2 billion in Malaysia and continued momentum from Vietnam QTPs, including the launch of the final phase of Eaton Park, the second phase of Springville, and the new Ambience project in Hai Phong.

5. Analyst Consensus: Analysts tracked by Bloomberg are looking at a consensus net profit of RM1.40 billion for FY2026, suggesting a potential 40% growth over the FY2025 record.

V. Investor Insights: Valuation and Technical Analysis (As of August/September 2025)

Valuation Snapshot: A Premium for Backlog

Gamuda trades at a significant premium compared to its industry peers, reflecting investor confidence in its substantial and visible backlog.

• Forward P/E: Approximately 34.9x, which is high relative to the construction peer average of 24.3x.

• Growth Context: Despite the premium valuation, Gamuda’s EPS growth (3-year CAGR of ~5%) is lower than some high-growth peers like Sunway Construction and Kelington Group. This suggests the market is pricing in the high asset quality, infrastructure expertise, and stability offered by the RM38 billion orderbook.

• Dividends: The trailing dividend yield is relatively low at ~1.75% (based on a 10 sen payout), falling below the sector average of ~2.2%. The payout ratio is conservative at approximately 20%.

• Market Action: As of September 19, 2025, the share price was RM5.52. The stock has gained 16.5% year-to-date.

Technical Structure: Bullish Consolidation

Based on technical analysis conducted in August 2025, the stock shows a strong bullish continuation pattern.

• Primary Trend: Unequivocally UP. The price action is characterized by Higher Highs and Higher Lows, confirming a strong bullish structure.

• Current Action: The movement from May to August 2025 is interpreted as a healthy pullback or consolidation (resembling a Bull Flag/Pennant pattern) within the larger uptrend.

• Key Levels:

◦ Immediate Resistance: ~MYR 5.75 – MYR 5.80. A breakout here is necessary to resume the uptrend.

◦ Critical Support: ~MYR 5.20. This low of the current pullback must hold to validate the bullish forecast.

• Momentum Indicators (RSI/MACD): The Relative Strength Index (RSI) indicates an overbought condition, suggesting caution ahead of a potential pullback. However, the MACD remains in positive territory, indicating that underlying bullish momentum has not been broken.

• Forecasted Target: Technical models project a continuation of the bull trend towards a new All-Time High of MYR 5.99 by December 17, 2025.

VI. Actionable Takeaway

Gamuda’s FY2025 results solidify its trajectory towards becoming a highly visible infrastructure and property player, underpinned by its RM38 billion backlog. The market is rewarding this visibility with a premium valuation.

• For Holders: The technical outlook remains bullish, provided the price stays above the critical support level of MYR 5.20.

• For New Buyers: The current price area (MYR 5.60 – MYR 5.70) represents a potential entry point following the healthy consolidation. A more conservative strategy involves waiting for a confirmed breakout above the MYR 5.80 resistance level, ideally accompanied by increased volume.

• Fundamental Confidence: Given the analyst consensus projecting RM1.40 billion profit in FY2026, the current stock price, particularly if it dips toward support, may present value backed by strong fundamental growth drivers in domestic construction and profitable overseas QTPs. A break below MYR 5.20 would require a strict stop-loss.