ViTrox Corporation Berhad announced its unaudited financial results for the second quarter ended June 30, 2025 (2QFY2025) on July 24, 2025.

Geographic Exposure (1H 2025 Revenue Contribution):

• China (primary market): 38%

• Malaysia: 15%

• Taiwan: 13%

• United States: 10%

The automotive sector alone accounted for 35% of ViTrox’s revenue in 1H 2025.

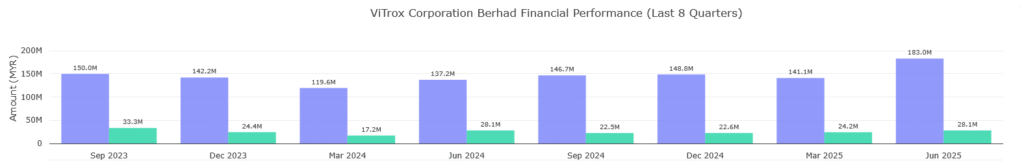

2. Q2 2025 Financial Performance

Key Metrics

| Metric | 2Q 2025 (MYR ‘000) | 2Q 2024 (MYR ‘000) | Change (YoY) | Change (QoQ) |

| Revenue | 183,043 | 137,199 | +33.4% | +29.7% |

| Profit Before Tax (PBT) | 37,907 | 31,077 | +22.0% | +38.3% |

| Profit for the period | 27,807 | 27,866 | -0.2% | +16.3% |

| Profit Attributable to Owners | 28,133 | 28,101 | +0.1% | +16.4% |

| Basic EPS (sen) | 1.49 | 1.49 | 0% | – |

| Proposed/Declared Dividend per Share (sen) | 0.70 | 1.10 | -36.4% | – |

Note: All figures in MYR ‘000 unless otherwise specified. EPS figures are in sen.

Highlights:

• Revenue Growth: ViTrox reported a significant increase in revenue by 33.4% year-over-year (YoY), reaching MYR183.04 million in 2QFY2025 compared to MYR137.2 million in 2QFY2024. This also represents a robust 29.7% increase quarter-on-quarter (QoQ) from MYR141.1 million in 1QFY2025. The growth was largely driven by a strong rebound in demand across all segments, particularly within the Machine Vision System (MVS) segment, which benefited from stronger shipments of tray-handlers and vision systems. Automated Board Inspection (ABI) also registered double-digit growth and remained the largest contributor. Specifically, standard MVS revenue was MYR14.9 million (up 48% QoQ), and tray-based MVS revenue reached MYR53.1 million (up 59% QoQ) in 2Q 2025. Total MVS shipments rose 51% to 350 units, and ABI shipments increased 69% to 152 units. Revenue for the last quarter exceeded analyst estimates by 7.0%.

• Profitability Challenges: Despite the strong revenue growth, net profit for the quarter remained relatively flat at MYR28.13 million compared to MYR28.10 million a year earlier. This was primarily due to a sharp rise in tax provision following the expiration of its pioneer status for tax exemption on June 16, 2025. Quarterly tax expenses tripled to MYR10.1 million from MYR3.21 million in the prior year. Additionally, unfavorable foreign exchange losses also partially offset the increase in profit before tax (PBT). The profit margin decreased to 15% from 21% in 2Q 2024 due to higher expenses.

• Cumulative Half-Year Performance (1HFY2025): ViTrox’s net profit for the cumulative six months ended June 30, 2025, rose 15.4% to MYR52.29 million from MYR45.33 million in 1HFY2024. Revenue for the period surged 26.2% to MYR324.16 million from MYR256.81 million. The revenue growth reflected a continued recovery across all regions and product lines. PBT for the period rose 30.8%.

• Dividends: For 2QFY2025, the group declared a lower proposed dividend of 0.70 sen per share, compared to 1.10 sen a year ago. A final dividend of 0.70 sen per share for FY2024 was approved on May 29, 2025, and paid on July 15, 2025

3. Growth Drivers & Risks

Opportunities

• Semiconductor Market Recovery: The global semiconductor market is anticipated to regain strong momentum in the second half of 2025.

• Emerging Technologies: Growth is supported by increasing demand in AI infrastructure, 5G-enabled devices, electric vehicles (EVs), and advanced medical technologies.

• Industry Investment: The World Semiconductor Trade Statistics (WSTS) projects over 11% market growth for 2025, indicating a healthy return to double-digit expansion. Additionally, Semiconductor Equipment and Materials International (SEMI) reports a 21% year-over-year increase in global semiconductor equipment investments, signaling that industry players are preparing for an upswing.

• R&D Investment: ViTrox remains committed to disciplined R&D investment to maintain technological relevance and benefit from the anticipated demand recovery.

Risks

• Tax Incentive Expiry: The pioneer status for ViTrox Technologies Sdn. Bhd. (VTSB), which provided tax exemption, expired on June 16, 2025. This led to a sharp increase in tax provision, significantly impacting net profit. A new application for tax incentives has been submitted and is currently under review by the Malaysian Investment Development Authority (MIDA).

• Foreign Exchange Volatility: Unfavourable foreign exchange loss negatively impacted profit before tax. Exchange-rate volatility is noted as a potential factor weighing on near-term margins.

• Trade Tensions and Tariffs: Higher reciprocal tariffs from the United States and global trade tensions could also weigh on near-term margins.

• Component Shortages: Persistent component shortages could further impact near-term margins.

• Muted Recovery: The local semiconductor industry continues to navigate a period of heightened uncertainty, with analysts describing the recovery as “muted and uneven”.

• Analyst Outlook: While there are optimistic long-term views, some analysts, like Nomura/Instinet, have downgraded ViTrox due to profitability impacts from tax provisions and forex movements, raising concerns about limited upside in the near term.

| Opportunities ☀️ | Risks ⚠️ |

|---|---|

| ✔ Semiconductor market recovery (WSTS: +11% 2025 growth) | ✖ Tax incentive expiry (higher tax provision) |

| ✔ AI, 5G, EV demand surge | ✖ Forex volatility (MYR fluctuations) |

| ✔ R&D investment for tech leadership | ✖ Trade tensions (US tariffs) |

4. Analyst Ratings & Price Targets

Analyst opinions on ViTrox stock in the past 3 months have resulted in an overall “neutral” rating based on 11 analysts.

• Average 1-year price target (TradingView): MYR3.57

◦ Max estimate: MYR5.30

◦ Min estimate: MYR2.10

• Average 1-year price target (Alpha Spread – Wall Street analysts): MYR3.05

◦ High forecast: MYR4.20 (8% Upside from current MYR3.90)

◦ Low forecast: MYR1.72 (56% Downside from current MYR3.90)

◦ Analysts from Alpha Spread forecast VITROX stock price to drop over the next 12 months.

• Nomura/Instinet: Recently downgraded ViTrox from Neutral to Reduce, while raising its price target to MYR3.50 from MYR3.08.

• AmInvest: Price call SELL, Price Target MYR2.75.

The consensus among analysts varies, but many suggest limited upside or even a downside from the current price, despite the strong revenue growth in 2Q 2025, largely due to concerns over margins and tax.

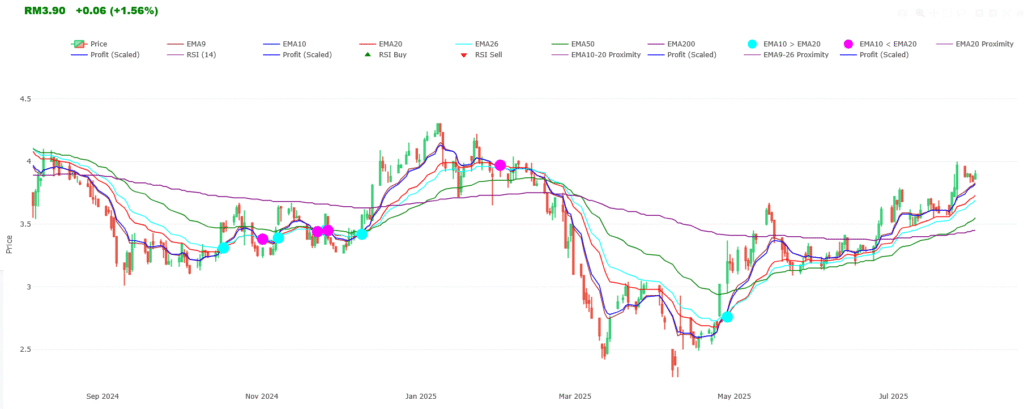

5. Technical Outlook (June-July 2025)

• Bullish Momentum: RHB Investment Bank Bhd identified ViTrox as a bullish trading idea in May 2025, citing strong technical momentum and positive chart patterns. ViTrox had broken above a key resistance level of RM3.25 with high trading volume, indicating a strong uptrend could be in motion.

• Price Projections: RHB Research expected the stock to climb towards RM3.50, with further upside potential towards RM3.70.

• Support Level: A drop below the RM3.10 support level would negate the bullish setup and trigger potential downside correction.

• Recent Technical Signals: As of late July 2025, ViTrox was noted to be in a short-term uptrend with strong technical signals and rising volume. However, the 12-month target around RM3.05 (Alpha Spread average) is below the current price, advising mid-term caution despite strong momentum

6. Investment Decision Summary

✅ Buy Arguments

• Robust Revenue Growth: ViTrox demonstrated strong revenue growth of 33.4% YoY and 29.7% QoQ in Q2 2025, driven by a significant rebound in demand across its core segments (ABI and MVS).

• Positive Market Outlook: The global semiconductor market is expected to regain strong momentum in the second half of 2025, supported by secular trends in AI, 5G, and EVs.

• Strategic R&D Investment: The company continues disciplined R&D investment to maintain technological relevance and capitalize on future opportunities.

• Strong Technical Momentum (Short-term): Recent technical analysis indicated a short-term uptrend with bullish signals, breaking key resistance levels.

⚠ Cautionary Factors

• Flat Net Profit: Despite impressive revenue growth, net profit remained flat due to a sharp increase in tax provision following the expiry of a key tax incentive. The new tax incentive application is still under review.

• Margin Compression: Profit margins decreased in Q2 2025 due to higher expenses and the tax impact.

• Foreign Exchange Exposure: Unfavorable foreign exchange movements negatively impacted profitability.

• External Headwinds: Ongoing risks include exchange-rate volatility, higher reciprocal tariffs from the US, and persistent component shortages, which could weigh on near-term margins.

• Analyst Concerns: Some analysts maintain a “neutral” or “reduce” rating, with average price targets suggesting limited upside or potential downside from current price levels.

📌 Actionable Insight

• Consider Entry: If you believe the long-term growth drivers outweigh the short-term headwinds and the tax incentive issue is resolved favorably.

• Monitor Support/Resistance: According to RHB Research in May 2025, a drop below RM3.10 could negate the bullish outlook. Momentum was strong as of late July 2025.

• Watch for Tax Incentive Resolution: The outcome of the new tax incentive application with MIDA will be crucial for future profitability.

• Manage Costs and Risks: ViTrox plans to manage costs prudently while pursuing emerging growth opportunities, acknowledging the challenging near-term margin environment.

| Buy Arguments ✅ | Cautionary Factors ⚠️ |

|---|---|

| Strong revenue growth (+33% YoY) | Flat net profit (tax impact) |

| Semiconductor market rebound | Margin compression |

| Bullish technical signals | Analyst downgrades (Nomura: Reduce) |

Action Recommendation

🟢 Consider Entry (if tax incentive resolved & RM 3.10 support holds)

🟡 Monitor (FX risks, component shortages)

🔴 Avoid (if drops below RM 3.10)

Disclaimer: This report is compiled solely based on the provided source excerpts for informational purposes and discussion. It does not constitute financial advice. Investment decisions should be made after conducting thorough personal research and consulting with a qualified financial advisor.